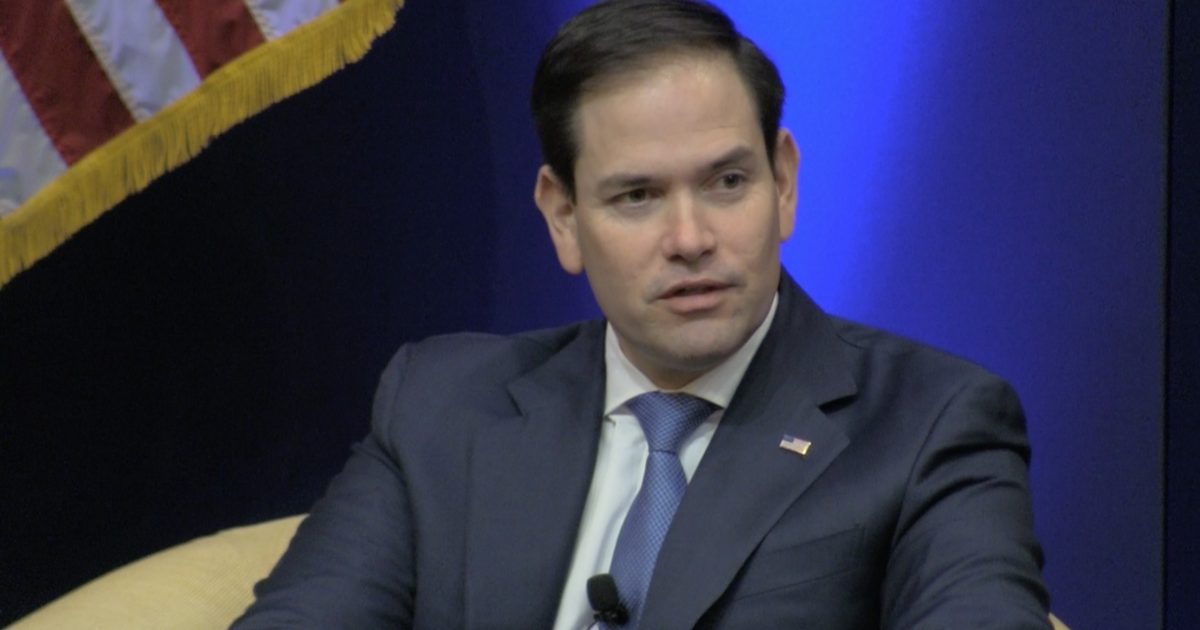

Senator Marco Rubio continues to focus on small businesses as he introduces a new bill called the “Small Business Fair Lending Act.”

This measure comes right after getting another small business centered bill through the U.S. Senate. The “Spurring Business in Communities Act” passed through the Senate last week, and it is on its way to President Trump’s desk.With the “Small Business Fair Lending Act,” the bill aims to “protect small businesses by closing a loophole used by nefarious lenders, and allowing the ability for them to be heard in a court of law.” In addition, the “bill codifies the Federal Trade Commission’s (FTC) 1985 ban on confessions of judgement, and extends it to include small business borrowers. Confessions of judgement require a borrower to give up his or her rights in court before obtaining a loan, and allows the lender to seize the borrower’s assets, without warning, in order to satisfy the debt.”

His office noted that “Although many states have banned this practice for small business loans and for individuals, borrowers remain exposed due to the current FTC loophole. The Small Business Lending Fairness Act provides small businesses with the same protections consumers already have. Last month, Bloomberg published an in-depth investigative report on this unscrupulous lending tactic, which has allowed creditors to destroy the lives of tens of thousands of borrowers without notice or opportunity for defense.”

Do you think the 2nd Amendment will be destroyed by the Biden Administration?(2)

Rubio also commented on the measure, detailing that “With this new bill, we are taking another step toward protecting America’s small businesses—the foundation of our economy—by preserving the right of a business to be heard in a court of law before a potential credit default. I remain committed to protecting our small businesses, and I hope my colleagues will join me in this effort by passing this bill.”