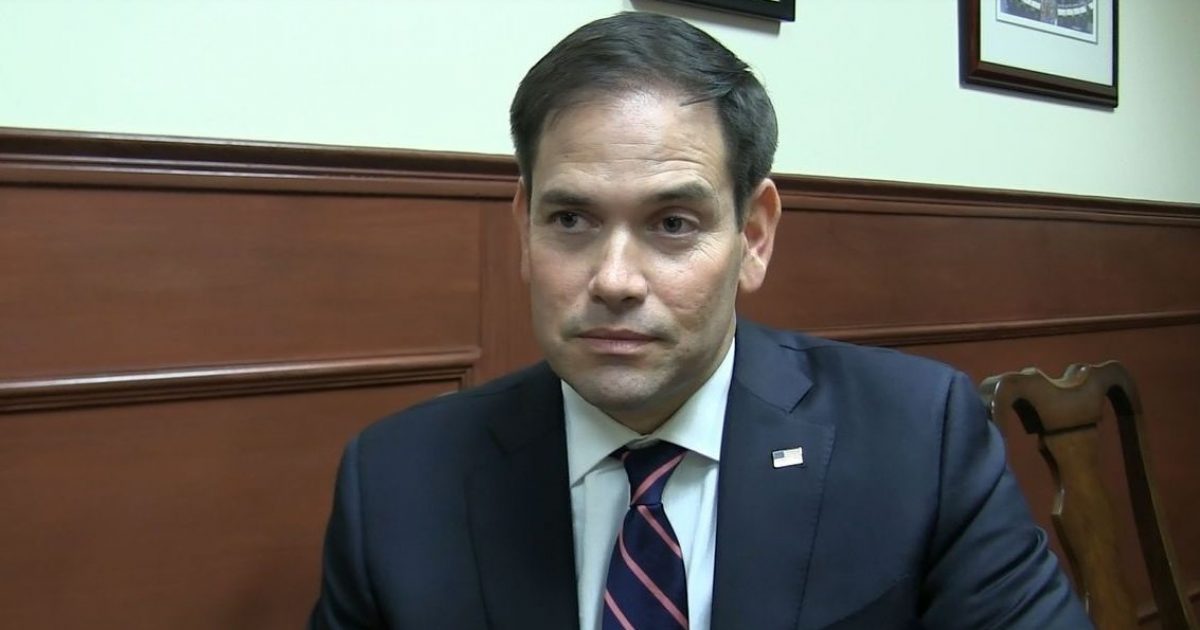

The Marco Tax reform watch continues, as the second term U.S. Senator is now saying that he will not support the $1.5 trillion House-Republican compromised tax bill.

Again, Rubio is largely supportive of the measure, but is a bit bothered that his amendment to increase child tax credit failed miserably on the floor of the Senate.Is Rubio, who wants to increase the $2ooo per child tax credit, a little bothered or embarrassed that his legislation bombed, sure he is. But will Rubio ultimately vote against the across-the-board tax cut for Americans, sure he will.

“I can’t in good conscience support it unless we are able to increase the refundable portion of it…There’s a way to do it, and we’ll be very reasonable.” -Sen. Marco Rubio

Do you think the 2nd Amendment will be destroyed by the Biden Administration?(2)

A not-so-happy Rubio has pulled the “Trump card” and has taken to Twitter to express is dissatisfaction with the how the tax reform bill has shaped up.

Tax negotiators didn’t have much trouble finding a way to lower the the top tax bracket and to start the corporate tax cut a year early. 1/2

— Marco Rubio (@marcorubio) December 14, 2017

Adding at least a few hundred $’s in refundable cuts for working families who seem to always be forgotten isn’t hard to do either 2/2

— Marco Rubio (@marcorubio) December 14, 2017

President Trump and other Senators like Texas’ Jim Cornyn are optimistic that Rubio’s concerned will be addressed, and the sophomore senator from Florida will vote in favor of the historic tax break that will benefit millions of Americans.

Rubio will get his.