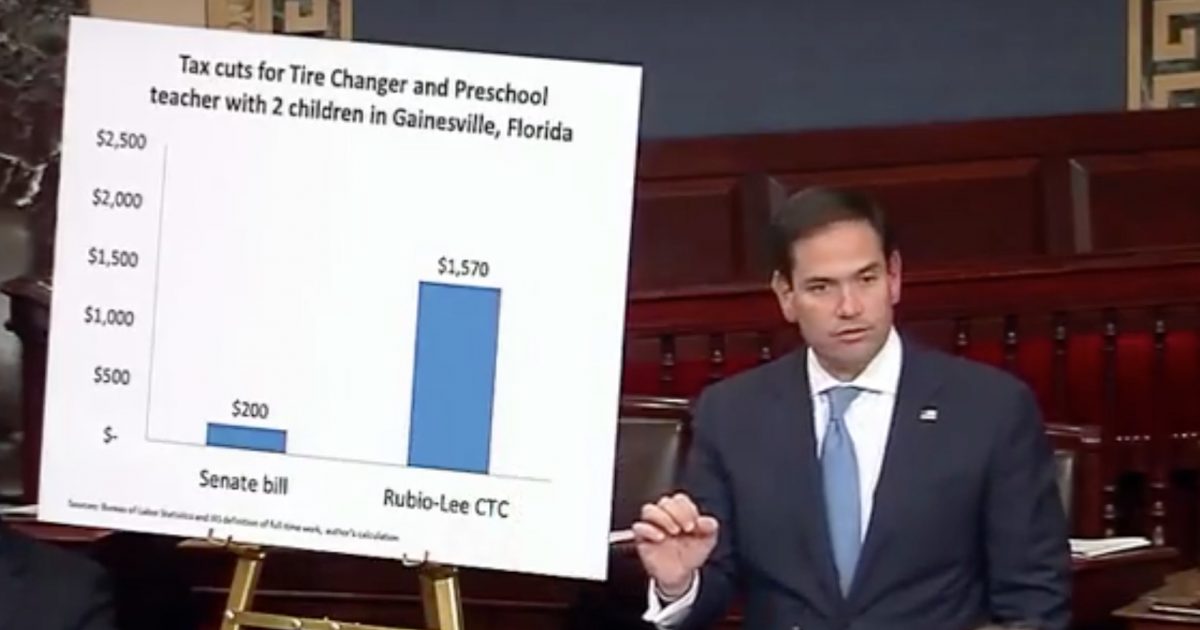

Armed with an easel and some nifty charts, Senator Marco Rubio took to the Senate floor to press for making the child tax credit measure he, Senator Mike Lee (R-UT) and Ivanka Trump have been pushing, applicable to current and future payroll tax rolls.

Rubio, who says he supports the current Senate tax reform, wants to amend the proposed tax plan with his child tax credit initiation for families, claiming that it would give them “the raise they deserve and need.”According to the census, the average family income in West Miami where I live, $38,000. Let’s say $39,000. That doesn’t mean West Miami is poor. I know the people there. They work hard. They pay their taxes. They raise their children well. They go to work five days a week, eight or nine hours a day, sometimes on the weekends. But because it’s a working class town, the nonrefundable increase we put in to the child tax credit doesn’t do much. As an example, based on the census data for West Miami, for that zip code that I live in, more than 2,500 children in this zip code meaning more than half of the total number of children living in that area would be receiving less than the full credit than they would otherwise be eligible for.

Why? Because their parents, their primary tax liability is the payroll tax. And you cannot help working families with a tax cut if you do not allow the cut to apply to the payroll tax. It’s as simple as that. We have to do that. You want to help people in this country? You really want to help them have a little more in their pocket? Then let’s do this proposal we have. By the way, I hear these economists and other people say, ‘well, it won’t do anything for growth.’ You really don’t understand how working Americans live. For someone who makes $38,000 a year or $35,000 a year, they basically spend every penny they make. They have to. You make $38,000 a year with two kids, you are spending every penny you make and then probably having to put the extra on your credit card, unfortunately. That will drive consumer spending. It will allow them to pay for some things they can’t buy now. These kids outgrow their shoes so fast. The book bags don’t make it through a year. These are so many things we could be helping families with. Our tax reforms should do that.”

Do you think the 2nd Amendment will be destroyed by the Biden Administration?(2)

Watch Rubio’s Senate floor address here: