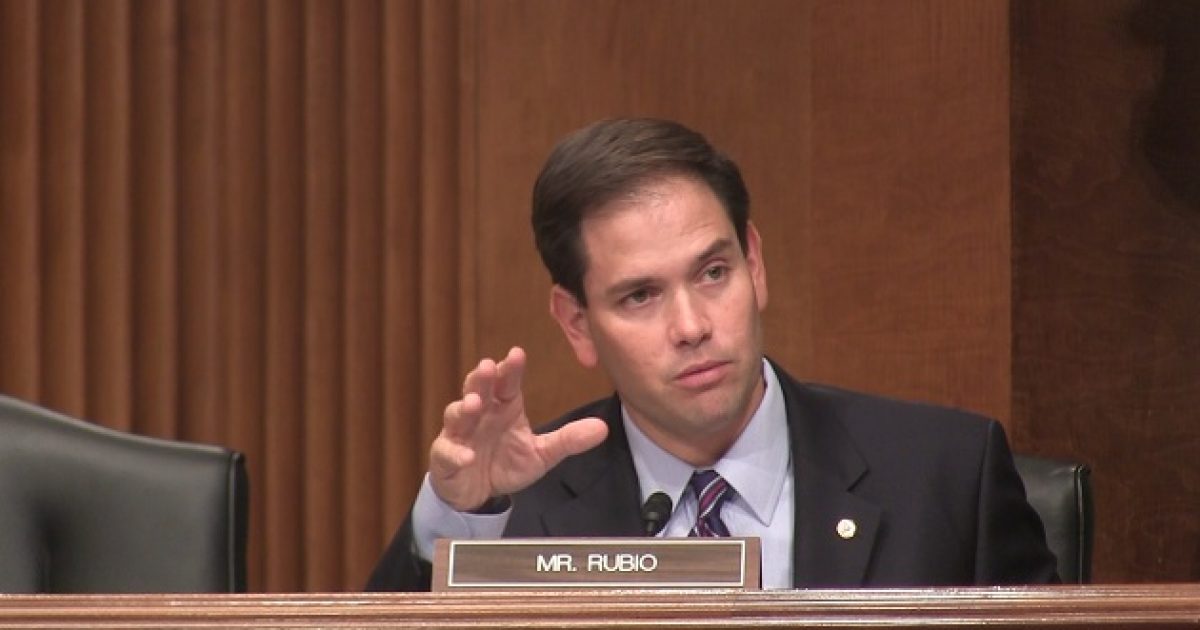

By JAVIER MANJARRES

Boom! U.S.Senator Marco Rubio has just proposed an amendment to the U.S. Constitution “providing that Congress shall make no law that imposes a tax on a failure to purchase goods and services.”What Rubio’s amendment would do is overturn the Obamacare “individual mandate tax” and keep future attempts by the Congress to force Americans and businesses to have to “purchase goods and services” it deems mandatory for them to have.

Rubio has been pushing to repeal Obamacare, but amendments to the Constitution are hard to pass. Regardless of whether his amendment is approved or not, it should make for an interesting debate over the individual mandate tax that is set to go into effect next year. Americans and insurance companies are bracing themselves for what is expected to be a very ‘taxing’ 2014 year.

take our poll - story continues belowDo you think the 2nd Amendment will be destroyed by the Biden Administration?(2)

Completing this poll grants you access to Shark Tank updates free of charge. You may opt out at anytime. You also agree to this site's Privacy Policy and Terms of Use.“ObamaCare is a disastrous policy that is not only destructive to job creation, it will also unleash the corrupt and scandal-ridden IRS on taxpayers simply for not buying health insurance,” said Rubio. “We should put our faith in the American people to decide what goods and services they want to buy, not have Congress dictate it and have the IRS empowered to harass Americans to make sure they do it. Let’s do everything we can to keep the IRS out of our health care and stop future congresses from forcing private citizens to spend their hard-earned money on products or services Washington is forcing on them.”

Last year the Supreme Court rejected the Obama Administration’s claim that ObamaCare’s individual mandate fell within Congress’s constitutional power to regulate commerce. A slim majority of the court, however, concluded that the mandate was, in fact, a tax and upheld its constitutionality. The unprecedented and controversial ruling potentially opens the door to future legislation that could force citizens to purchase goods or services at the risk of being hit with a tax penalty.

If passed by Congress and ratified by the states, the “Right to Refuse” amendment would reassert constitutionally limited government and exempt the more than 6 million individuals and businesses expected to be hit with thousands of dollars in mandate taxes set to begin in 2014. It would also permanently prevent Congress from passing future legislation forcing Americans to choose between purchase of goods and services or tax penalties. –Senator Marco Rubio

Share and “Like” the story above and leave a comment. Follow The Shark Tank on Twitter and Facebook